Prospect Capital: Acquires Consumer Lender QC Holdings

April 11, 2025

NEWS

NEW YORK, April 11, 2025 (GLOBE NEWSWIRE) — A portfolio company of Prospect Capital Corporation (“Prospect”) (NASDAQ: PSEC) and QC Holdings, Inc. (QCCO) today announced they have entered into a definitive merger agreement pursuant to which, subject to certain conditions and on the terms set forth in the merger agreement, Prospect would acquire QC Holdings in an all-cash transaction, for $2.00 per share, for a total enterprise value of approximately $115 million (the “Merger”).

The Merger was unanimously approved by the board of directors of QC Holdings and by the holders of a majority of the outstanding shares of the Company’s common stock. No other stockholder approval is required. Completion of the Merger is subject to the receipt of certain required regulatory approvals, as well as certain other closing conditions customary for transactions of this nature. The transaction is expected to close in 40 to 60 days.

Upon completion of the transaction, QC Holdings’ common stock will no longer be listed on the OTC Pink Market. The Company will remain headquartered in Lenexa, Kansas.

The QC Holdings management team, led by Darrin Andersen, President and Chief Executive Officer, will continue to lead the Company post-Merger in their current roles.

“QC Holdings has built a strong foundation based on innovation, customer service, and operational excellence,” said Mr. Andersen. “This Merger provides an excellent premium for our stockholders above our stock price. Our access to greater capital through Prospect will position us for future growth and innovation, ensuring that we will continue to provide increased value to our customers.”

“Prospect looks forward to supporting the growth of QC Holdings, a strong consumer finance business with a 40-year history,” said Grier Eliasek, President and Chief Operating Officer of Prospect.

Blank Rome LLP served as legal advisor to Prospect. Stinson LLP served as legal advisor to QC Holdings.

About QC Holdings, Inc.

QC Holdings specializes in consumer-focused alternative financial services and credit solutions and, for more than 40 years, has been providing credit options for people underserved by traditional banking institutions. Its core products include a variety of short-term loans and financial services. In the United States, QC Holdings operates as “LendNation” through more than 325 retail locations in 12 states. In Canada, QC Holdings offers loans through 19 retail locations and online.April 11, 2025 Prospect Capital Press Release

ANALYSIS

We’ll briefly review the QC Holdings business franchise.

We’ll also determine where the new portfolio company fits in PSEC’s recently announced re-positioning strategy.Agenda

Pay Day Plus

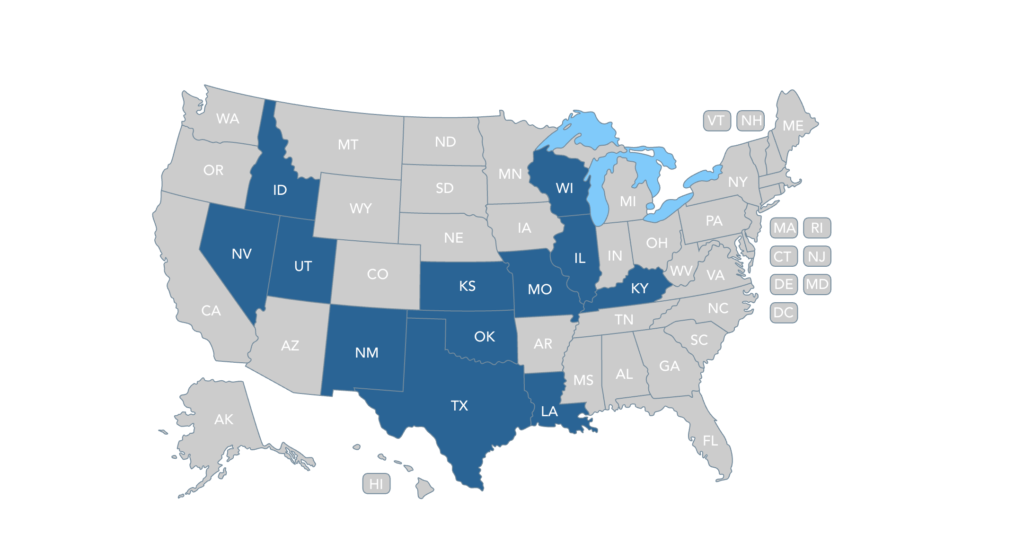

The company – operates under the name LendNation – and serves both consumers and small businesses, providing pay-day loans, installment loans and “title collateralized loans” to the former and factoring to the latter. LendNation has a network of 240 locations in multiple states and in Canada. See the map below:

Mystery

Although technically a public company trading in the pink sheets, we could not find any SEC filings after 2015 for the company.

Pitchbook offers a useful overview of the business, but does not have any more up to date financial information to offer.

Here is a link to Seeking Alpha’s information about the company, mostly many years out of date.

Given the above, we cannot tell you anything about the assets under management of the firm, or the construction of its balance sheet, or its profitability or any other useful information.

Not Alone

Most BDCs do not get involved in consumer finance although a number of players have acquired controlling interests in commercial finance operations aimed at small businesses.

PSEC, by contrast, is a “Control” investor in at least 4 other consumer finance companies: Credit Central Loan Company; First Tower Finance Company; Nationwide Loan Company and a segment of National Property REIT.

Up And Down

Going by the most recent valuations, the performance of the businesses has been mixed.

Credit Central is valued at only two-thirds of its investment cost of $75mn and very little cash income is being received on this business owned since 2012.

Nationwide Loan Company has a cost of $56mn and a FMV of $40mn. The investment dates back over a decade but PSEC has recently advanced new loans while valuing its equity position at a substantial discount – suggesting the advances may be “rescue financing”.

On the other hand, First Tower Finance – which dates back to 2014 – has an investment cost of $465mn and a given FMV of $665mn, even though no dividend has been paid in the last year on the equity portion and one-third of interest charged is paid in kind.

We can’t determine any numbers at National Property REIT (“NPRC”). All we know – from footnotes – is that NPRC:

…invests in online consumer loans and rated secured structured notes through American Consumer Lending Limited (“ACLL”) and National General Lending Limited (“NGL”), respectively, its wholly owned subsidiaries. PSEC 10-Q IIIQ 2024

Modest

In terms of investment size, this latest acquisition is relatively small as PSEC has advanced over a billion dollars into individual companies before and has an overall AUM of $7.1bn

Contradiction?

PSEC’s management announced late in 2024 a drastic change in strategy.

We discussed the matter in an article on November 8, 2024 and said the following:

Going forward, PSEC – as spelled out in its press release and to a greater extent on its conference call – is changing strategies.

After years of being heavily invested in CLO equity (generally a no-no where BDCs are concerned) and in real-estate (a rare asset on BDC balance sheets), the goal is to divest itself of those assets.

Also – and harder to identify – management wants to sell off “successful middle market deals where we also hold equity”. We imagine the BDC is referring to “Control” investments where PSEC has the right to direct an exit and harvest any equity upside.

Presumably, this means companies First Tower Finance which PSEC lists as having equity with a cost of $31mn and a FMV of $189mn. The BDC essentially owns most of the shares.BDC Reporter – Prospect Capital: Reports IIIQ 2024 Results – Reduces Distribution – November 4, 2024

This latest acquisition seems to be at variance with our understanding of PSEC’s new strategic direction.

Moreover, with the U.S. economy potentially heading into recession and the North American consumer financial stretched by all accounts, we don’t understand the attraction of owning a business like QC Holdings.

Maybe PSEC is betting on more potential customers being created by the likely harsher macro conditions ahead?

VIEWS

Not Sold

Although we know very little about the acquisition, we’re not impressed by this move from PSEC’s famously “idiosyncratic” management team.

We doubt that this move will do anything to improve its reputation with Wall Street or with its investor base (the stock is down 62% since its peak in 2021) and could complicate its plans to become more of a middle of the road BDC lender serving the middle and upper middle market.

Thankfully, the amount of capital committed – so far – is modest and should not move the needle too much.

However, it is always possible PSEC will invest additional funds to grow the business and/or merge one or more of its other consumer finance companies into QC.

Whatever happens, those of us on the outside are unlikely to learn what is happening because these “Control” investments on BDC books are like “black boxes” about which very little is known.

OUR VIEW